The hybrid platform for

medium-sized direct investments

The hybrid platform for medium-sized direct investments

The platform

The platform

We set the new standard for digital, cost-efficient and professionally supported equity transactions. We combine personal support from experienced advisors with innovative tools - all on one platform. In this way, we offer investors quality-checked access to investments in medium-sized and growth companies.

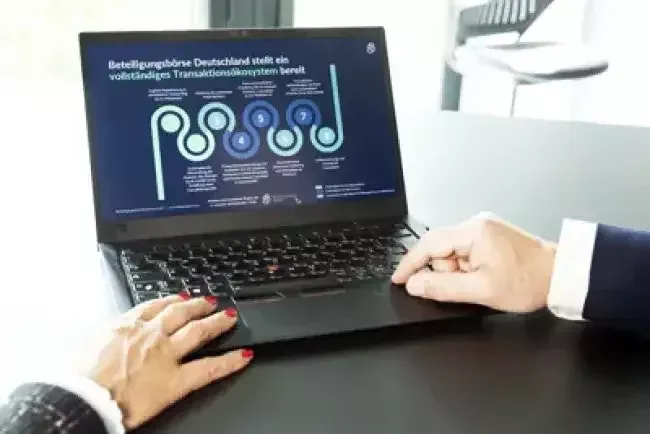

1

The company seeking capital registers on our platform. This is followed by a personal onboarding meeting with our experts.

2

After an initial financial check, an indicative company valuation and the appropriate transaction structure are determined.

3

From our large network of experienced transaction advisors, we select the most suitable partner for the company.

4

On our platform, the company goes through an innovative, digitized transaction preparation (due diligence).

5

In cooperation between the transaction advisor and the company, standardized and meaningful transaction documentation is prepared. These go through a final quality assurance of the investment exchange.

6

Thousands of active equity investors are registered on our platform. In consultation with the companies, targeted investors are approached from this pool.

7

The subsequent transaction negotiations are carried out cost-effectively with the involvement of our specialist lawyers and on the basis of standardized contractual documents.

8

The participation process is usually concluded by notarial recording.

![]() Preparation

Preparation ![]() Implementation

Implementation ![]() Conclusion

Conclusion

What do we do differently?

Holistic process

Entire process from client onboarding to due diligence to closing through an integrated platform, the first of its kind.

Large investor base

Thousands of already registered purchase requests available from the beginning.

Verified offer

Each transaction undergoes seller due diligence and is placed in accordance with our market leading

standards.

Reliable partner

Founding partners include COMPANYLINKS, the Hamburg Stock Exchange, CANEI and Pinsent Masons.

For entrepreneurs

Equity capital is the foundation of every company. Around 150,000 German SMEs currently have a need for capital. Unlike debt capital, however, this cannot be found at a bank or savings bank. At the same time, a good equity ratio promotes the company's positive credit rating, which is necessary when accessing short-term debt capital.

Your fast access to fresh equity is the Beteiligungsbörse! As the first platform in the German-speaking region, we offer you the complete process for efficient capital procurement from EUR 1 million - from the initial meeting to the closing. We support you throughout with innovative technology and personal expertise. All this at transparent and fair conditions.

- Structuring fee EUR 5,000

- Transaction fee EUR 5,000 plus variable base fee for the external transaction advisor

- Performance-based closing fee of 6% of the transaction volume. All fees from 1 and 2 are creditable against this.

As an entrepreneur, do you need additional equity to drive the growth of your business? Do you, as a managing director, see with concern how the equity ratio has decreased as a result of the recent crises? Or, as a shareholder, would you like to sell part of your stake?

Then register here for a no-obligation consultation with one of our experts.

For investors

Direct investments in medium-sized companies are an interesting asset class with attractive return potential. Investments in smaller SMEs have so far mostly failed due to access and excessive due diligence and transaction costs.

The investment exchange now opens up the investment route for investors in German SMEs from EURO 50,000. Through our broad network of banks and consultants, we have a good deal flow for interesting investment offers. Thanks to innovative digital partners and experienced consultants, we ensure serious due diligence and standardized contract drafting. As a result, you receive only verified and meaningful investment offers that meet your requirements. For acquirers, our offer is free of charge - both upon registration and in the event of success.

Register your interest here and receive attractive investment offers soon.

For consultants

Are you an M&A advisor and avoid minority investments because of the high transaction costs? As an auditor, tax advisor or lawyer, do you have clients who need equity but you don't know how to help them raise it?

Then Beteiligungsbörse is exactly the right partner for you. We offer innovative due diligence methods, access to thousands of vetted investors and standardized contracts. Our dynamic processes are tailored to the needs of small transactions with a volume of EUR 1 million or more - by professionals for professionals. In the process, you always remain actively involved as a partner and advisor.

To support transactions, we are continuously looking for new M&A advisors to whom we assign transactions from our pipeline for support. Market-driven compensation structures, access to our unparalleled due diligence methods and our large investor pool are all part of the package.

Register here to learn more about collaboration opportunities!

About us

Our experienced team - your reliable partner for corporate investments

Our experienced team - your reliable partner for corporate investments

The investment exchange has a team of highly qualified experts with many years of experience and broad specialist knowledge. In addition, our partner companies contribute extensive digital and technical expertise. As a co-partner, Hamburger Börse stands for traditional values and solidity. Together, we are developing the new standard for medium-sized company investments.

We are convinced that our innovative solutions will shape the future of this market segment. in this market segment in this market segment.

The management team

Matthias Wittenburg

In addition to Beteiligungsbörse, Matthias Wittenburg is also founder and managing partner of COMPANYLINKS, a leading platform for company sales in German-speaking countries. Prior to this, he spent 25 years in the banking business, most recently as Head of Corporates & Markets at a Landesbank. He holds an MBA from Cardiff University and completed the Oxford Advanced Management and Leadership Programme at Saïd Business School.

Holger Kruse

Holger Kruse most recently worked for the Reimann family office. His focus there was primarily on managing the venture portfolio with an investment focus on software companies. Prior to that, Holger worked in various areas of corporate and investment banking. He holds a Master of Finance from the Frankfurt School of Finance and Management.

Holger Reinhardt

Holger Reinhardt brings over ten years of experience in SaaS product development and over 20 years in API and enterprise integration. He has been CTO at various SaaS startups for over 10 years, including 6 years as CTO at Haufe Group. He received his MBA from the University of Louisville and his Diplom-Inf. in Computer Science and Electronics from FAU Erlangen-Nürnberg.

About us

The leading matching platform for fully discreet and professionally accompanied company sales in German-speaking countries. This experience and the network of COMPANYLINKS were the basis for the foundation of Beteiligungsbörse Deutschland.

The leading international law firm with a high level of digital expertise provides our tools for standardized, cost-effective due diligence and, through its subsidiary VARIO, lawyers for contract drafting.

Blog

Markt und Mittelstand is Germany's largest magazine for family businesses and the podcast reports from up close for and about SMEs. This episode is about minority shareholdings in SMEs - brokered by Beteiligungsbörse Deutschland.

He has been dealing with the complete sale of medium-sized companies for years, but in everyday life Wittenburg has noticed that there is an increasing demand for partial sales, but so far no platform where such transactions can be handled effectively.

In the current episode #3 of the Beteiligungsbörse Deutschland Podcast, everything revolves around the topic of "company sales, investments and valuations". Ayse Mese, Managing Director of DUB Deutsche Unternehmerbörse, talks to Matthias Wittenburg and provides exciting insights into the world of company valuations, company sales, company succession, franchising, insolvency and company investments.

Debt Advisors - The financing advisors

The current episode #2 of the Beteiligungsbörse Deutschland Podcast is about "Debt Advisors - The Financing Advisors". The Senior Managing Director and Co-Head Financial Sponsor Advisory of Herter & Co. Paul H. F. Kim answers Matthias Wittenburg, Co-Founder Beteiligungsbörse Deutschland's questions in the podcast.